Cap Rate Calculator

Calculate the capitalization rate (cap rate) for your real estate investment property. Analyze NOI, property value, and investment returns to evaluate commercial and residential income properties.

Investment Analysis

Cap Rate

Net Operating Income (NOI)

Effective Gross Income

Operating Expense Ratio

Value at Target Cap Rate

Price per Square Foot

Understanding Cap Rate

The capitalization rate (cap rate) is a fundamental metric in real estate investing that measures the rate of return on an investment property based on the income it generates. It's calculated by dividing the Net Operating Income (NOI) by the property's current market value or purchase price.

How Cap Rate is Calculated

Cap Rate = (NOI ÷ Property Value) × 100

Step 1: Calculate Effective Gross Income = (Rental Income + Other Income) × (1 - Vacancy Rate)

Step 2: Calculate NOI = Effective Gross Income - Operating Expenses

Step 3: Calculate Cap Rate = (NOI ÷ Property Value) × 100

Interpreting Cap Rates

Higher Cap Rates (8-12%+)

Higher returns but typically higher risk. Properties in emerging markets, B/C class properties, or those requiring significant management. Greater potential for cash flow but may face challenges with appreciation or tenant quality.

Medium Cap Rates (6-8%)

Balanced risk and return. Typical for stable markets with good fundamentals. A-/B+ class properties in secondary markets or good B class in primary markets. Solid cash flow with moderate appreciation potential.

Lower Cap Rates (3-6%)

Lower risk, stable investments. Prime locations in major markets, Class A properties. Lower immediate cash flow but greater potential for appreciation. Attracts institutional investors seeking stability.

Key Considerations

- Market Comparison: Cap rates vary significantly by market, property type, and location. Compare against similar properties in the same area.

- Not Total Return: Cap rate only measures income return, not appreciation. Total return = Cap Rate + Appreciation.

- Operating Expenses: Ensure operating expenses are accurate and comprehensive. Missing expenses inflate NOI and cap rate.

- Financing Impact: Cap rate is calculated on the entire property value, not considering financing. Cash-on-cash return measures leveraged returns.

- Property Condition: Deferred maintenance or needed improvements can make high cap rates misleading if future capital expenditures aren't considered.

- Market Trends: Rising cap rates indicate declining property values or increasing investor required returns. Falling cap rates suggest increasing values.

Using Cap Rate Effectively

Compare Like Properties

Only compare cap rates for similar property types in similar markets. A 7% cap rate for a Class A multifamily in San Francisco isn't directly comparable to a 7% cap rate for a strip mall in a tertiary market. Property class, location, tenant quality, and lease terms all impact risk profiles.

Verify Income and Expenses

Carefully review rent rolls, lease agreements, and historical operating statements. Sellers may present pro-forma numbers that don't reflect reality. Verify vacancy rates, market rents, and confirm all operating expenses are included. Missing items like management fees, reserves, or maintenance can significantly inflate NOI.

Don't Rely on Cap Rate Alone

Cap rate is one tool among many. Also consider cash-on-cash return (if financing), internal rate of return (IRR) for multi-year projections, debt service coverage ratio (DSCR) for financing eligibility, and qualitative factors like market growth potential, job growth, and supply/demand dynamics.

Related Calculators

Note: Cap rate is one of many metrics used to evaluate real estate investments. This calculator provides estimates based on the information you enter. Actual cap rates and returns may vary based on market conditions, property-specific factors, tenant quality, lease terms, and unforeseen expenses. Cap rate calculations assume stabilized operations and do not account for financing, capital expenditures, taxes, or appreciation. Always perform thorough due diligence including property inspections, market analysis, and financial review before making investment decisions. Consider consulting with real estate professionals, appraisers, and financial advisors to understand the specific characteristics and risks of any investment property.

Recommended Calculator

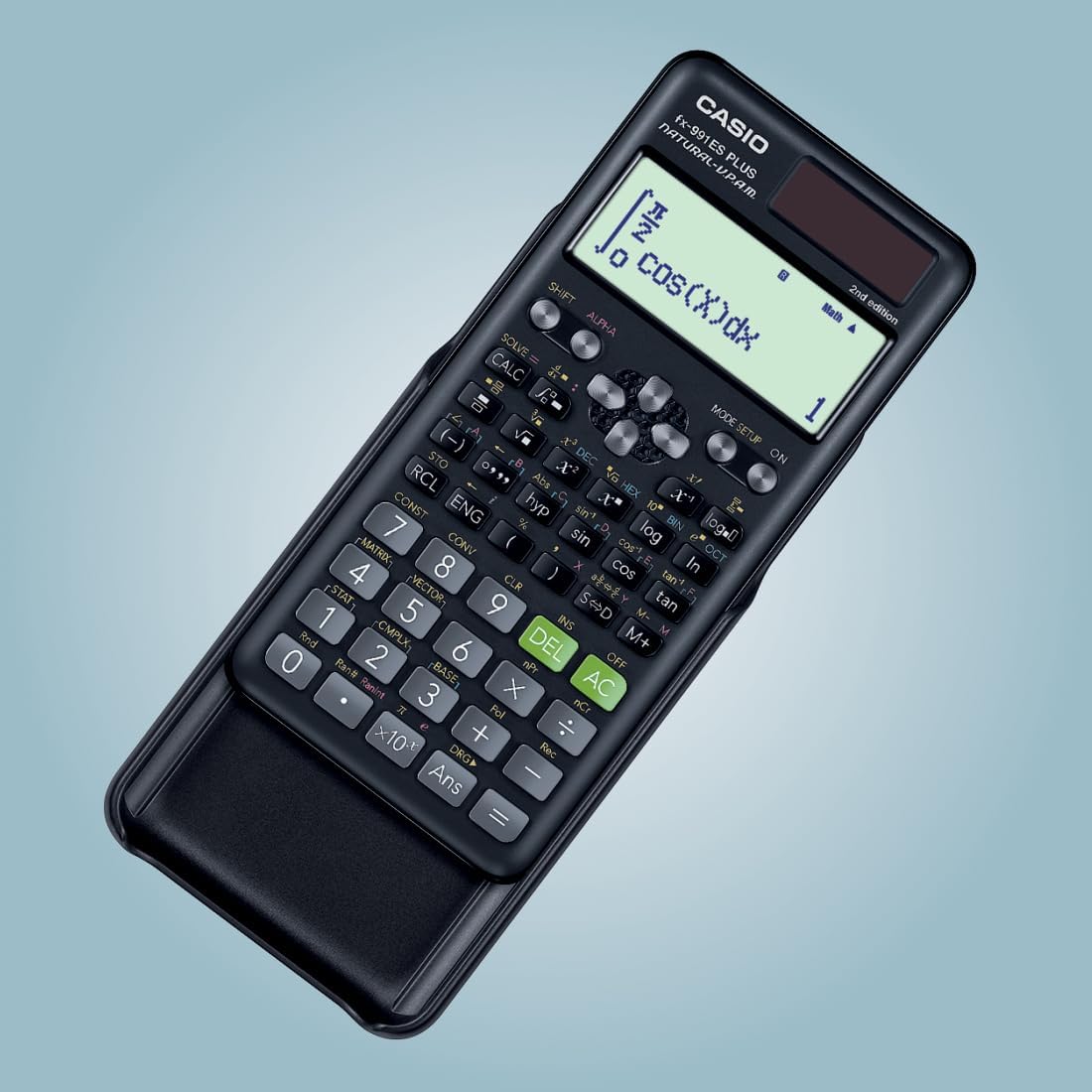

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon