Estate Tax Calculator

Estimate federal estate tax and inheritance after taxes

Gross Estate

Estate Tax

Net Estate

Tax Breakdown

Taxable Estate

Effective Tax Rate

Calculation Details

Gross Estate

Less: Deductions

Plus: Lifetime Gifts

Less: Exemption ($13,610,000) -$13,610,000

Estate Tax Due (40%)

About Estate Tax

The federal estate tax is a tax on the transfer of property at death. For 2024, the estate tax exemption is $13,610,000, meaning estates valued below this amount are not subject to federal estate tax. The tax rate on amounts above the exemption is 40%.

What's Included in Your Estate?

- Real estate and other property

- Financial accounts and investments

- Life insurance proceeds (if you own the policy)

- Business interests

- Personal property and collectibles

Common Deductions

- Marital deduction (transfers to surviving spouse)

- Charitable contributions

- Mortgages and debts

- Estate administration expenses

- State estate taxes paid

Note: This calculator provides federal estate tax estimates only. Many states have their own estate or inheritance taxes with different exemption amounts and rates. Consult with an estate planning professional for comprehensive advice.

As an Amazon Associate, we earn from qualifying purchases.

Recommended Calculator

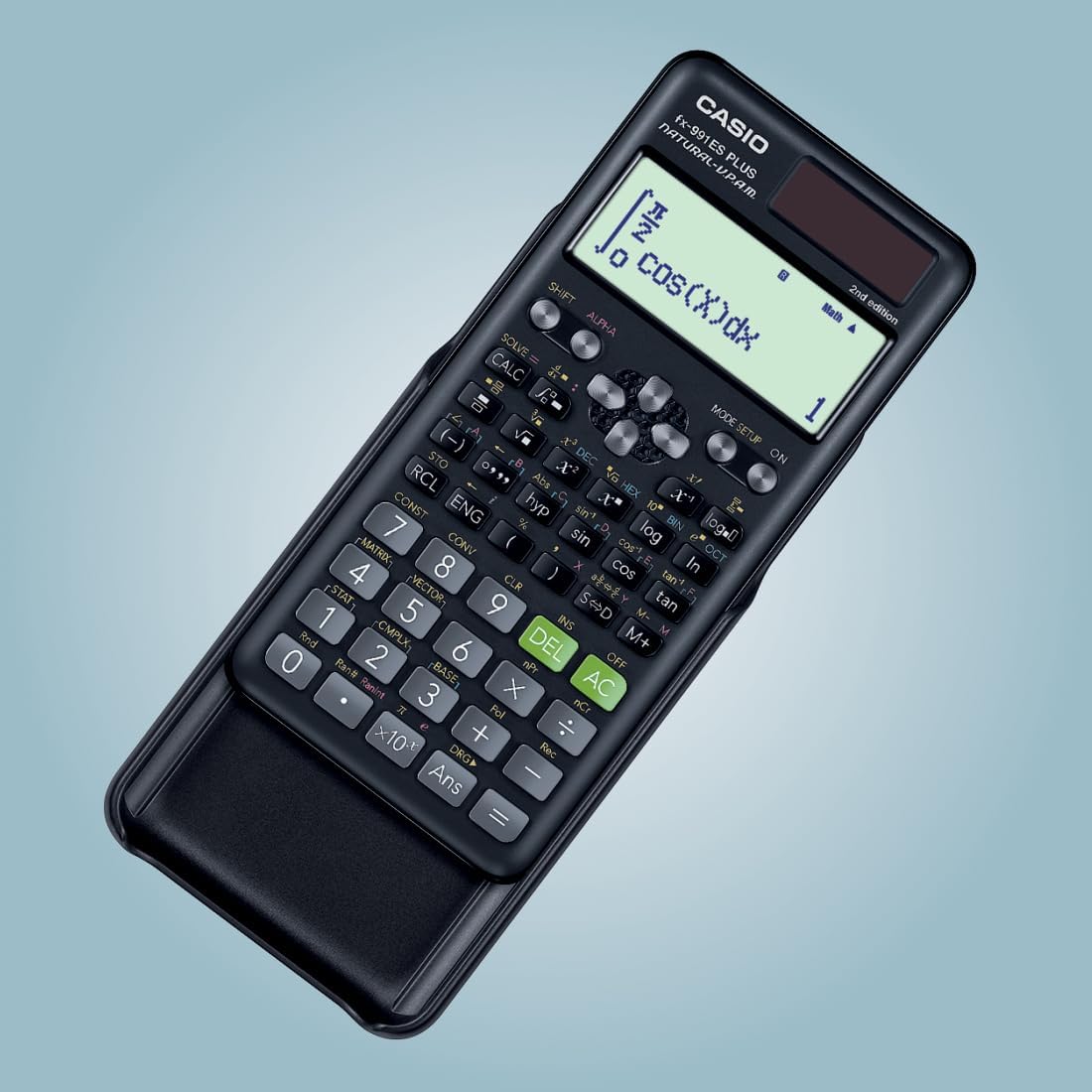

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon