Home Affordability Calculator

Calculate how much house you can afford based on your income, debts, and financial situation.

Income and Debts

Loan Details

Property Expenses

Home Affordability Results

Maximum Home Price

Down Payment

Monthly Principal & Interest

Total Monthly Payment

Monthly Property Tax

Monthly Insurance

Debt-to-Income Ratio

Understanding Home Affordability

Determining how much house you can afford is crucial to making a smart home purchase. Lenders use several rules of thumb to assess your ability to repay a mortgage, primarily the 28% and 36% rules.

The 28/36 Rule

- 28% Rule: Your monthly mortgage payment (including principal, interest, taxes, and insurance - PITI) should not exceed 28% of your gross monthly income.

- 36% Rule: Your total monthly debt payments (including mortgage, car loans, credit cards, student loans, etc.) should not exceed 36% of your gross monthly income.

Key Factors Affecting Affordability

Income-Based Factors

- • Gross annual income

- • Existing monthly debt obligations

- • Employment stability and history

- • Additional income sources

- • Future income prospects

Loan-Based Factors

- • Down payment percentage

- • Interest rate on the mortgage

- • Loan term (15, 20, 30 years)

- • Credit score and history

- • Type of mortgage (FHA, VA, conventional)

Debt-to-Income Ratio Guidelines

36% or Lower - Excellent

You're in great shape. Most lenders will consider you a low-risk borrower.

37-43% - Acceptable

You may qualify, but you'll have less financial flexibility. Some loan programs accept up to 43% DTI.

Over 43% - High Risk

You may struggle to get approved, and approval could come with higher rates or stricter terms.

Tips to Increase Your Home Buying Power

- Reduce existing debt: Pay down credit cards, auto loans, and student loans before applying

- Improve your credit score: Higher scores qualify for better interest rates

- Increase your down payment: More money down means a smaller loan and better terms

- Shop for better rates: Even 0.25% difference can save thousands over the loan term

- Consider a longer term: 30-year vs 15-year mortgages have lower monthly payments (but higher total interest)

- Add a co-borrower: Combined income can increase buying power

Related Calculators

Note: This calculator provides estimates based on common lending guidelines (28/36 rule). Actual loan approval amounts may vary based on credit score, employment history, debt-to-income ratio, down payment, and other factors. These calculations do not include HOA fees, maintenance costs, or other homeownership expenses. Consult with a mortgage professional for personalized advice and accurate pre-approval amounts.

Recommended Calculator

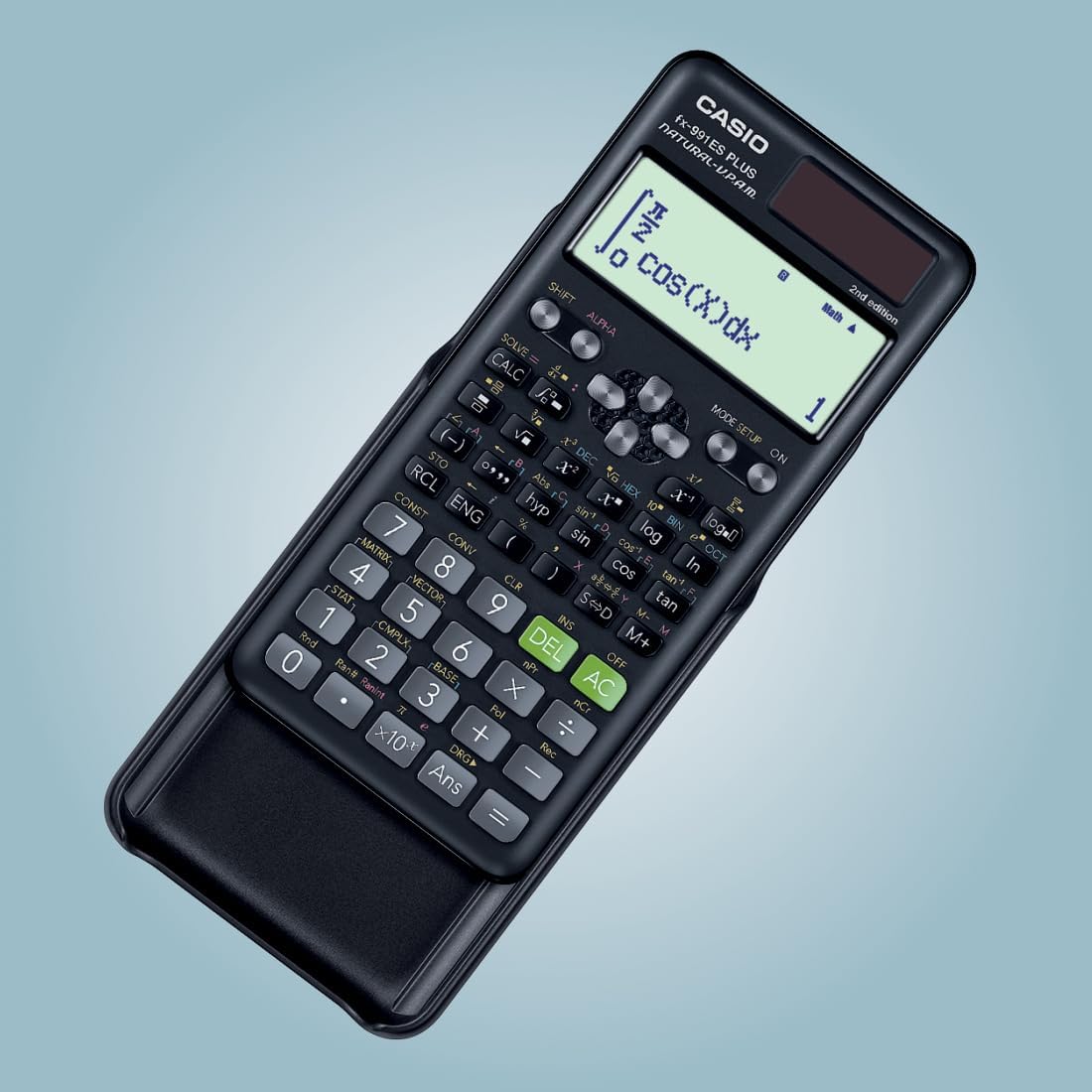

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon