MAGI Calculator

Calculate your Modified Adjusted Gross Income for tax benefits eligibility

Income Sources

Adjustments to Income

Additions Back to AGI

Total Income

AGI

MAGI

Calculation Breakdown

Total Adjustments

Total Additions

About MAGI

Modified Adjusted Gross Income (MAGI) is used to determine eligibility for certain tax benefits and retirement contributions. It's calculated by taking your AGI and adding back certain deductions and income exclusions.

Common Uses of MAGI

- IRA contribution limits and deductibility

- Roth IRA contribution eligibility

- Premium tax credit eligibility for health insurance

- Education tax benefits

- Child tax credit phase-outs

Related Calculators

Note: This calculator provides estimates based on common MAGI calculations. Actual MAGI may vary based on specific circumstances and tax rules. Consult with a tax professional for accurate tax planning.

As an Amazon Associate, we earn from qualifying purchases.

Recommended Calculator

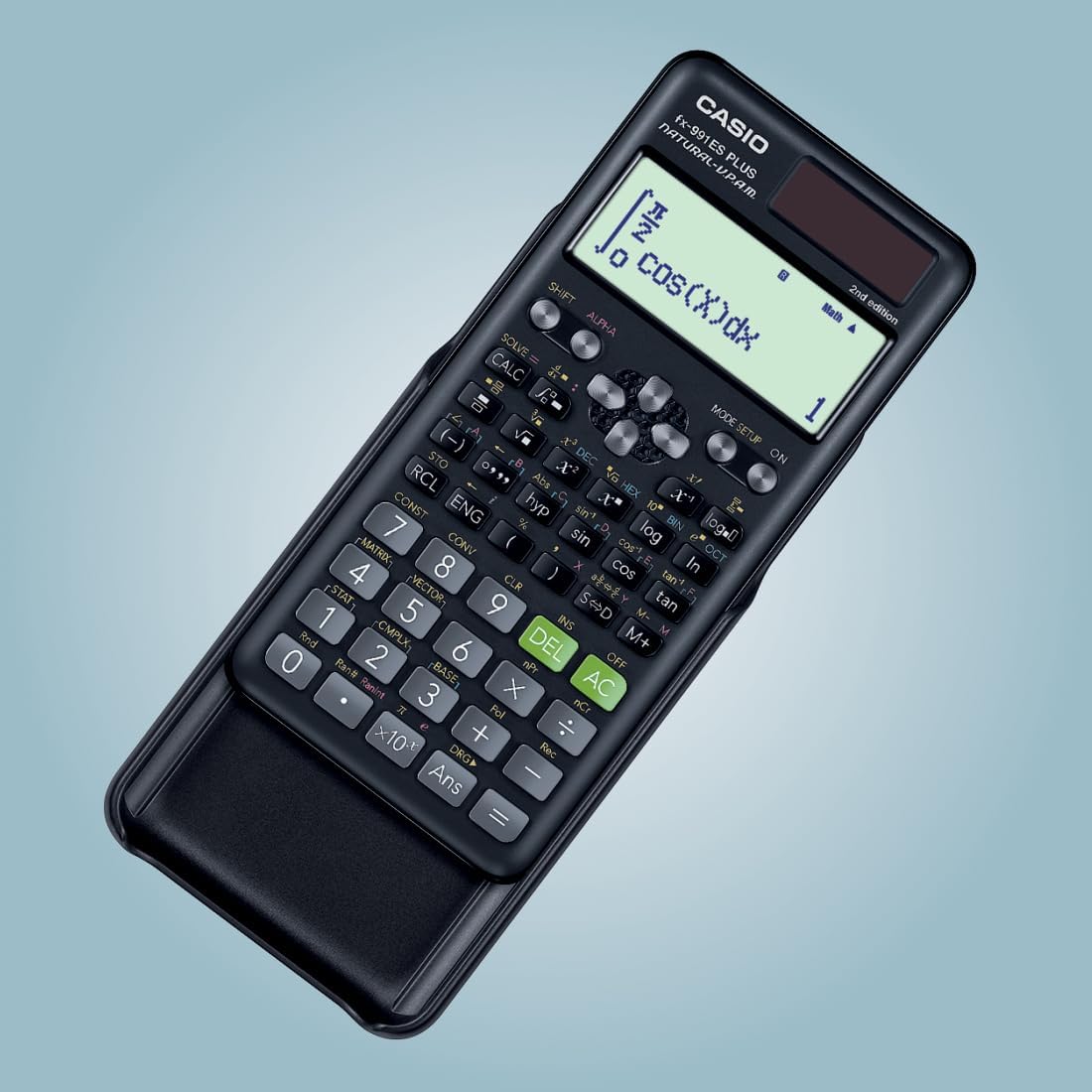

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon