Mortgage Points Calculator

Determine if paying discount points makes financial sense for your mortgage by analyzing costs, savings, and break-even period.

Monthly Payment Comparison

Original Payment

New Payment

Monthly Savings

New Interest Rate

Cost Analysis

Points Cost

Break-even Period

Total Savings Over Loan Term

Understanding Mortgage Points

What Are Mortgage Points?

Mortgage points, also called discount points, are fees you pay upfront to your lender to reduce your mortgage interest rate. One point equals 1% of your loan amount. Points are a form of prepaid interest.

How Points Work

Each point typically reduces your interest rate by about 0.25%, though this varies by lender and market conditions. For example, on a $300,000 loan, one point costs $3,000 and might lower your rate from 6.5% to 6.25%.

Break-even Analysis

The break-even period is the time it takes for your monthly payment savings to equal the cost of the points. If you plan to keep your mortgage longer than the break-even period, paying points may save you money. If you sell or refinance before breaking even, you lose money on the points.

Tax Implications

Points paid on a home purchase are typically tax-deductible in the year you pay them, while points on a refinance must be deducted over the life of the loan. Consult a tax professional for your specific situation.

When Should You Pay Points?

- You plan to stay long-term: If you'll keep the mortgage past the break-even period, points can save money

- You have extra cash: Using cash reserves to buy down your rate only makes sense if you don't need the money elsewhere

- Rates are high: When interest rates are elevated, the savings from buying them down are more significant

- You want lower payments: Points reduce your monthly payment, improving cash flow

- You itemize deductions: If you itemize on your taxes, you can deduct the points

When NOT to Pay Points

- You plan to sell or refinance within a few years

- You need cash for closing costs or emergency fund

- You could invest the money elsewhere for higher returns

- You're buying an investment property with high cash needs

Related Calculators

Note: This calculator provides estimates based on typical point costs and rate reductions. Actual terms vary by lender, credit score, loan type, and market conditions. The rate reduction per point is not guaranteed and may be higher or lower. Points paid on a refinance have different tax implications than points on a home purchase. This calculator does not account for the opportunity cost of using cash for points instead of other investments. Consult with a mortgage professional and tax advisor to discuss specific options for your situation.

Recommended Calculator

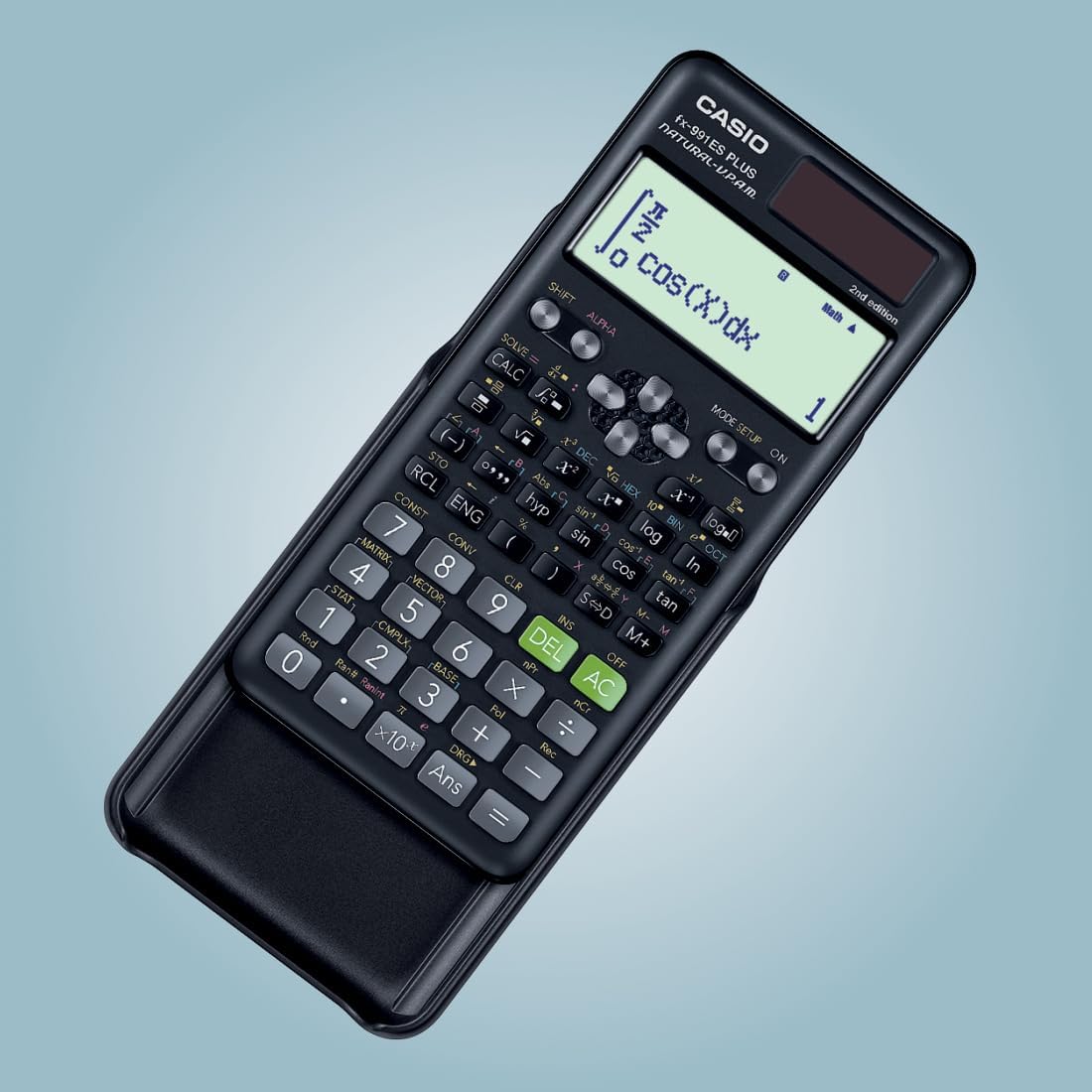

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon