ROI Calculator

Calculate your Return on Investment (ROI) and analyze investment performance

Total Return

ROI

Annualized ROI

Investment Breakdown

What is ROI?

ROI (Return on Investment) is a key financial metric used to evaluate the profitability or efficiency of an investment. It measures the return generated relative to the cost of the investment and is expressed as a percentage. ROI is widely used in personal finance, business decisions, and investment analysis because it provides a straightforward way to assess and compare different opportunities.

Formula for ROI

ROI = (Net Profit / Cost of Investment) × 100

Where:

- Net Profit = Total returns or gains − Investment cost

- Cost of Investment = The total amount spent on the investment

Example of ROI Calculation

If you invest $1,000 in a project and earn $1,200 in return, the net profit is $200 ($1,200 − $1,000). Using the ROI formula:

ROI = ($200 / $1,000) × 100 = 20%

Why ROI is Important

- Simplicity: ROI is easy to calculate and understand, making it accessible for both beginners and professionals.

- Comparison: It allows investors to compare the profitability of various investments, regardless of type or size.

- Decision-making: ROI serves as a benchmark for determining whether an investment is worth pursuing.

Related Calculators

Disclaimer: This calculator provides estimates for educational purposes only. ROI calculations do not account for taxes, inflation, fees, or market volatility. Past performance does not guarantee future results. Always consult with a qualified financial advisor before making investment decisions.

Recommended Calculator

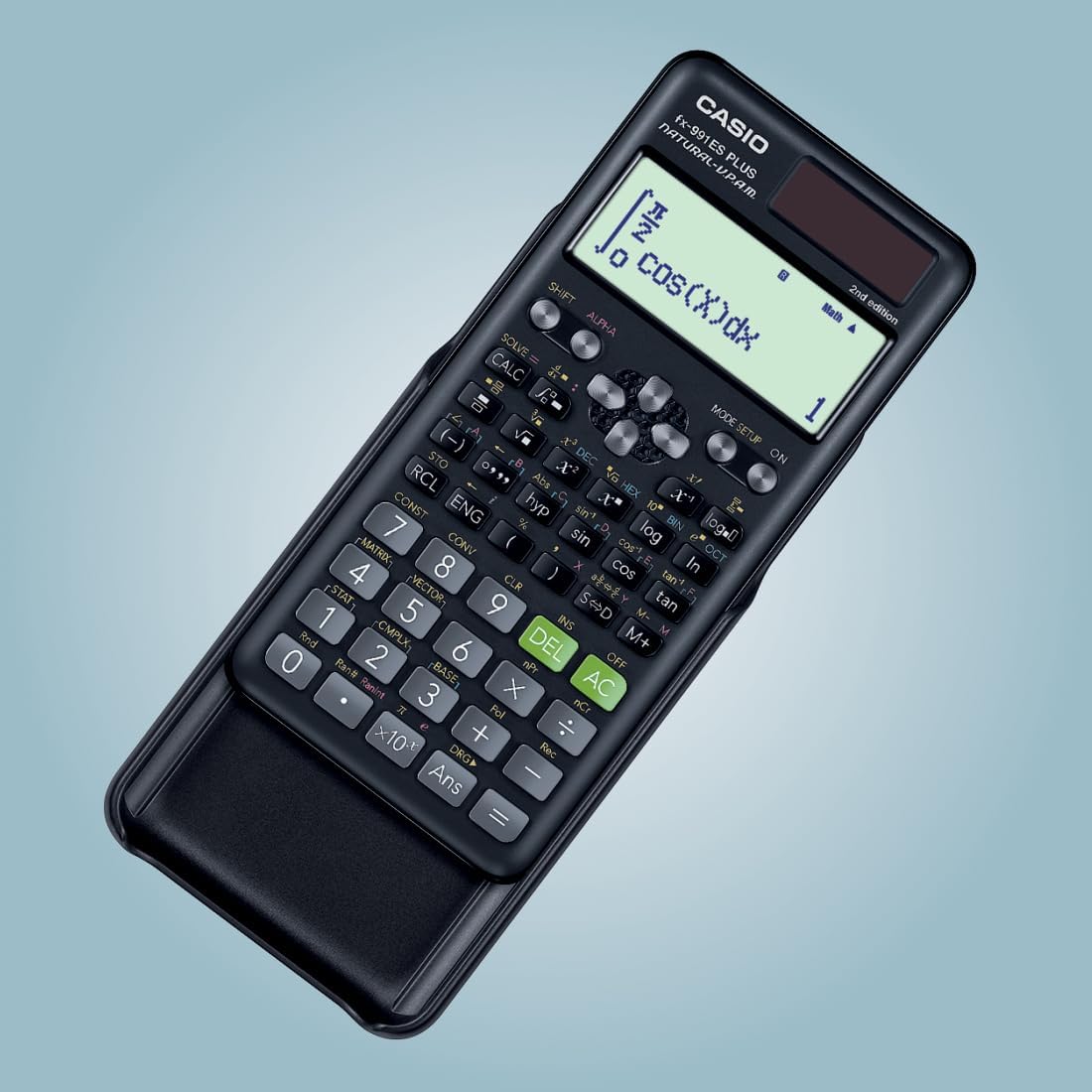

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon