Sales Tax Calculator

Calculate sales tax and final price for any purchase amount

Purchase Amount

Tax Amount

Total Amount

About Sales Tax

Sales tax is a consumption tax imposed by governments on the sale of goods and services. In the United States, sales tax rates vary by state and local jurisdiction, typically ranging from 4% to 10% of the purchase price.

How to Calculate Sales Tax

The formula for calculating sales tax is:

Sales Tax = Purchase Amount × (Tax Rate ÷ 100)

Total Amount = Purchase Amount + Sales Tax

State Sales Tax Rates (2024)

| State | State Tax Rate | Avg. Local Tax Rate | Combined Rate |

|---|---|---|---|

| Alabama | 4.00% | 5.29% | 9.29% |

| Alaska | 0.00% | 1.82% | 1.82% |

| Arizona | 5.60% | 2.78% | 8.38% |

| California | 7.25% | 1.60% | 8.85% |

| Delaware | 0.00% | 0.00% | 0.00% |

| Florida | 6.00% | 1.00% | 7.00% |

| Illinois | 6.25% | 2.61% | 8.86% |

| Louisiana | 4.45% | 5.11% | 9.56% |

| Montana | 0.00% | 0.00% | 0.00% |

| New Hampshire | 0.00% | 0.00% | 0.00% |

| New York | 4.00% | 4.53% | 8.53% |

| Oregon | 0.00% | 0.00% | 0.00% |

| Tennessee | 7.00% | 2.55% | 9.55% |

| Texas | 6.25% | 1.95% | 8.20% |

| Washington | 6.50% | 2.88% | 9.38% |

Note: This table shows a selection of US states. Rates are current as of January 1, 2024. Local rates are weighted by population to compute an average local tax rate.

Related Calculators

Note: This calculator provides estimates for informational purposes only. Actual sales tax rates may vary by location and type of purchase. Some items may be exempt from sales tax. Consult your local tax authority for accurate tax rates and regulations.

Recommended Calculator

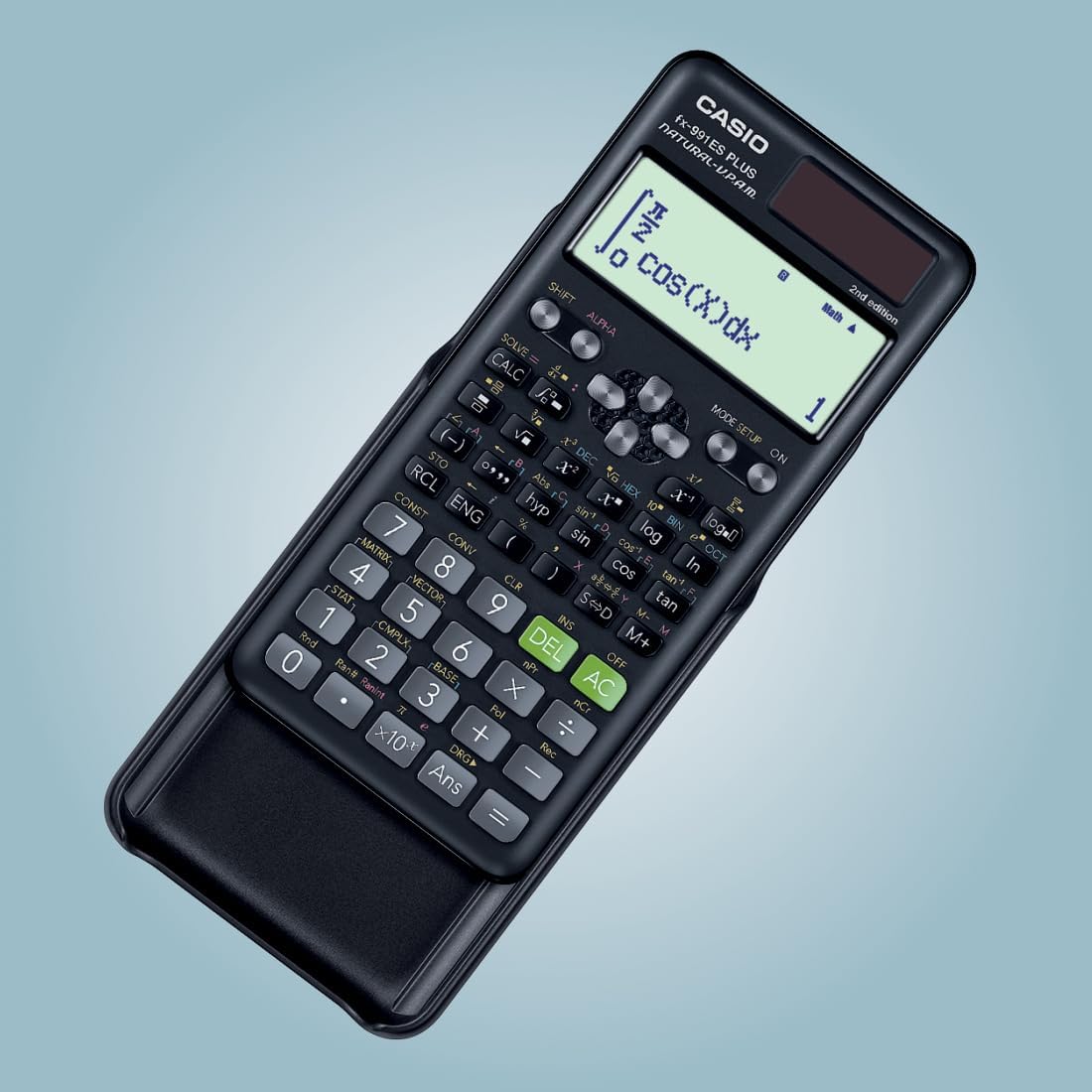

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon