VA Loan Calculator

Calculate your VA loan payments including funding fee, monthly payment breakdown, and amortization schedule for veterans and active military.

Estimated Monthly Payment:

Principal & Interest

Property Taxes

Insurance

VA Loan Details

VA Funding Fee

Total Loan Amount

Funding Fee Rate

Understanding VA Loans

What is a VA Loan?

VA loans are government-backed mortgages available to Veterans, active duty service members, National Guard and Reserve members, and eligible surviving spouses. Backed by the Department of Veterans Affairs, these loans offer significant benefits including no down payment requirement, no private mortgage insurance (PMI), and competitive interest rates.

VA Funding Fee

The VA funding fee is a one-time payment that helps offset the cost of the VA loan program to taxpayers. The fee varies based on loan type, down payment amount, and whether you've used your VA loan benefit before. Veterans with service-connected disabilities and Purple Heart recipients are exempt from this fee. The funding fee can be financed into your loan.

Funding Fee Rates

- First-time use, 0% down: 2.3% of loan amount

- First-time use, 5-9% down: 1.65% of loan amount

- First-time use, 10%+ down: 1.4% of loan amount

- Subsequent use, 0% down: 3.6% of loan amount

- IRRRL refinance: 0.5% of loan amount

- Cash-out refinance: 2.3% of loan amount

Key Benefits

- No down payment: Buy a home with $0 down (up to VA loan limits)

- No PMI: Save hundreds per month compared to conventional loans

- Lower rates: Typically 0.25-0.5% lower than conventional

- Flexible credit: More lenient credit requirements

- Limited closing costs: VA restricts what lenders can charge

- Reusable benefit: Can be used multiple times

VA Loan Types

Purchase Loan

The standard VA loan for buying a home. No down payment required, though putting down 5% or more reduces the funding fee. Can be used for primary residences including single-family homes, condos, townhouses, and manufactured homes.

IRRRL (Interest Rate Reduction Refinance Loan)

Also called a "streamline refinance," the IRRRL lets you refinance an existing VA loan to a lower interest rate. Features minimal paperwork, no appraisal requirement, and a low 0.5% funding fee. Must result in a lower interest rate or convert from an ARM to a fixed-rate mortgage.

Cash-Out Refinance

Refinance any mortgage (VA or non-VA) into a VA loan while taking cash out from your home equity. Can be used for debt consolidation, home improvements, or other expenses. Requires an appraisal and has a 2.3% funding fee.

Related Calculators

Note: This calculator provides estimates based on current VA loan guidelines. Actual terms, costs, and funding fees may vary based on lender, location, loan amount, and individual circumstances. VA loan limits apply in most areas, though high-cost areas may have higher limits. Veterans with service-connected disabilities and Purple Heart recipients are exempt from the funding fee. Always verify current VA funding fee rates and eligibility requirements with a VA-approved lender. This calculator assumes standard property tax and insurance rates which vary by location.

Recommended Calculator

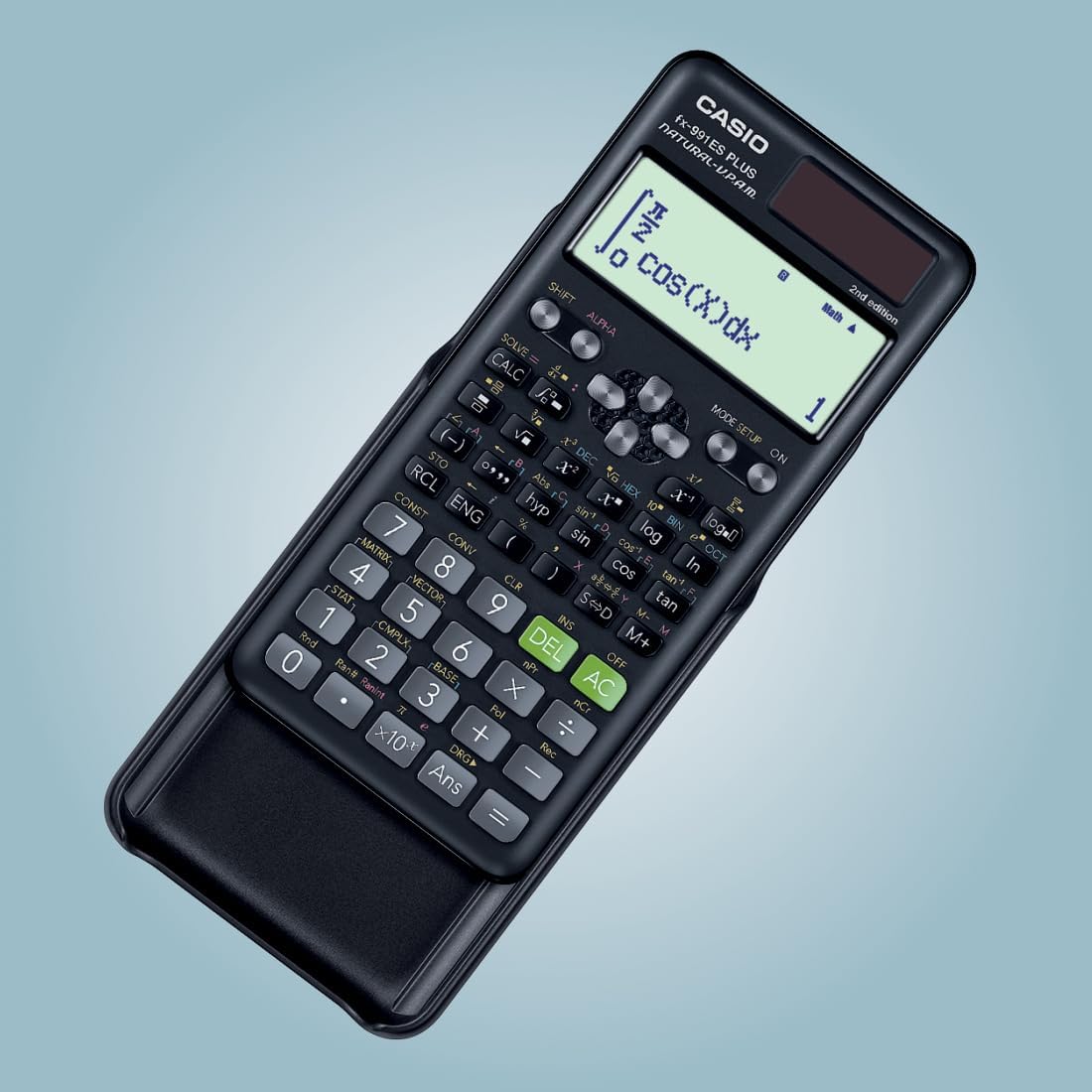

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon