VAT Calculator

Calculate Value Added Tax (VAT) and final prices for goods and services

VAT Calculation Results

Net Price

VAT Amount

Final Price

VAT Breakdown

About Value Added Tax (VAT)

VAT is a consumption tax placed on goods and services. It is charged at each stage of production and distribution, with the final consumer bearing the total VAT cost. VAT is used in over 160 countries worldwide as a major source of government revenue.

Common VAT Rates by Region

- UK: 20% standard rate, 5% reduced rate, 0% zero rate

- European Union: Between 17% and 27% standard rates

- Reduced rates: 5-15% for essential goods and services

- Zero rate: 0% for certain exports and essential goods

- Some countries exempt specific items like food, books, or medical supplies

VAT Inclusive vs Exclusive

- VAT Exclusive: The price shown does not include VAT. VAT is added to the price at checkout.

- VAT Inclusive: The price shown includes VAT. This is the final price the customer pays.

References

VAT information and rates are based on guidelines from tax authorities:

Related Calculators

Note: VAT rates and rules vary by country and region. This calculator provides basic calculations for educational purposes. Consult with a tax professional or check local tax regulations for specific guidance applicable to your situation.

Recommended Calculator

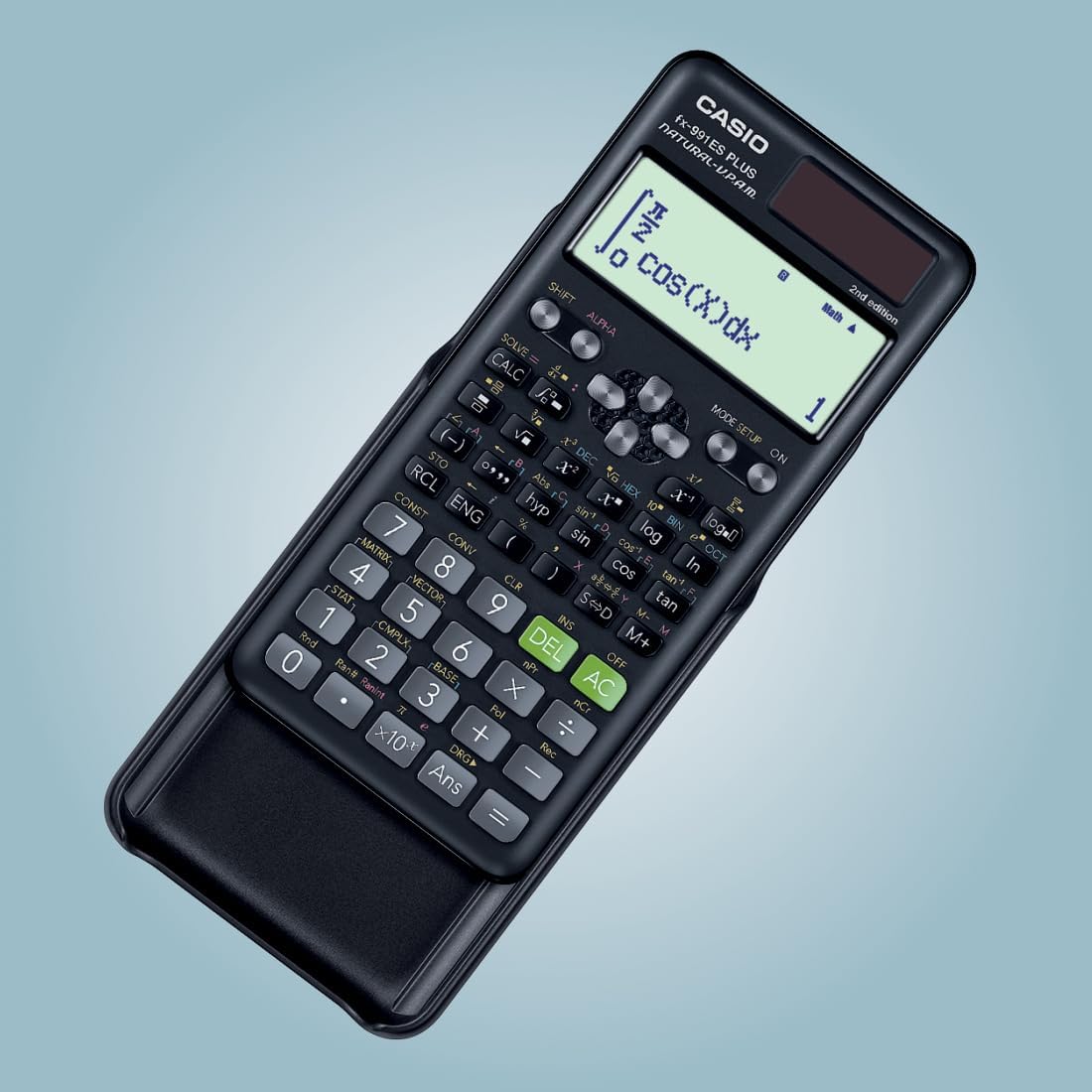

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon