Lottery Tax Calculator

Calculate taxes on lottery winnings and estimate your take-home amount

Federal Tax

State Tax

Net Amount

Effective Tax Rate

Tax Breakdown

Federal Tax Rate

State Tax Rate

Total Effective Tax Rate

Take-Home Percentage

About Lottery Taxes

Lottery winnings are subject to both federal and state taxes. The IRS considers lottery winnings as gambling income, which is taxed as ordinary income at the federal level. Additionally, most states impose their own taxes on lottery winnings.

Lump Sum vs. Annuity

- Lump Sum: You receive about 60% of the advertised jackpot amount immediately, but pay taxes all at once.

- Annuity: You receive the full advertised amount spread over 29 annual payments, with taxes due each year on the amount received.

Tax Considerations

- Federal tax withholding is mandatory at 24% for gambling winnings over $5,000

- Additional federal taxes may be due when filing your tax return

- State tax rates vary significantly by location

- Some cities may impose additional local taxes

State Lottery Tax Rates (2024)

| State | Tax Rate |

|---|---|

| Alabama | 0.00% |

| Alaska | 0.00% |

| Arizona | 4.80% |

| Arkansas | 7.00% |

| California | 0.00% |

| Colorado | 4.00% |

| Connecticut | 6.99% |

| Delaware | 0.00% |

| Florida | 0.00% |

| Georgia | 5.75% |

Related Calculators

Note: This calculator provides estimates only. Actual tax liability may vary based on your specific circumstances, local tax laws, and other factors. Consult with a tax professional for accurate tax planning.

As an Amazon Associate, we earn from qualifying purchases.

Recommended Calculator

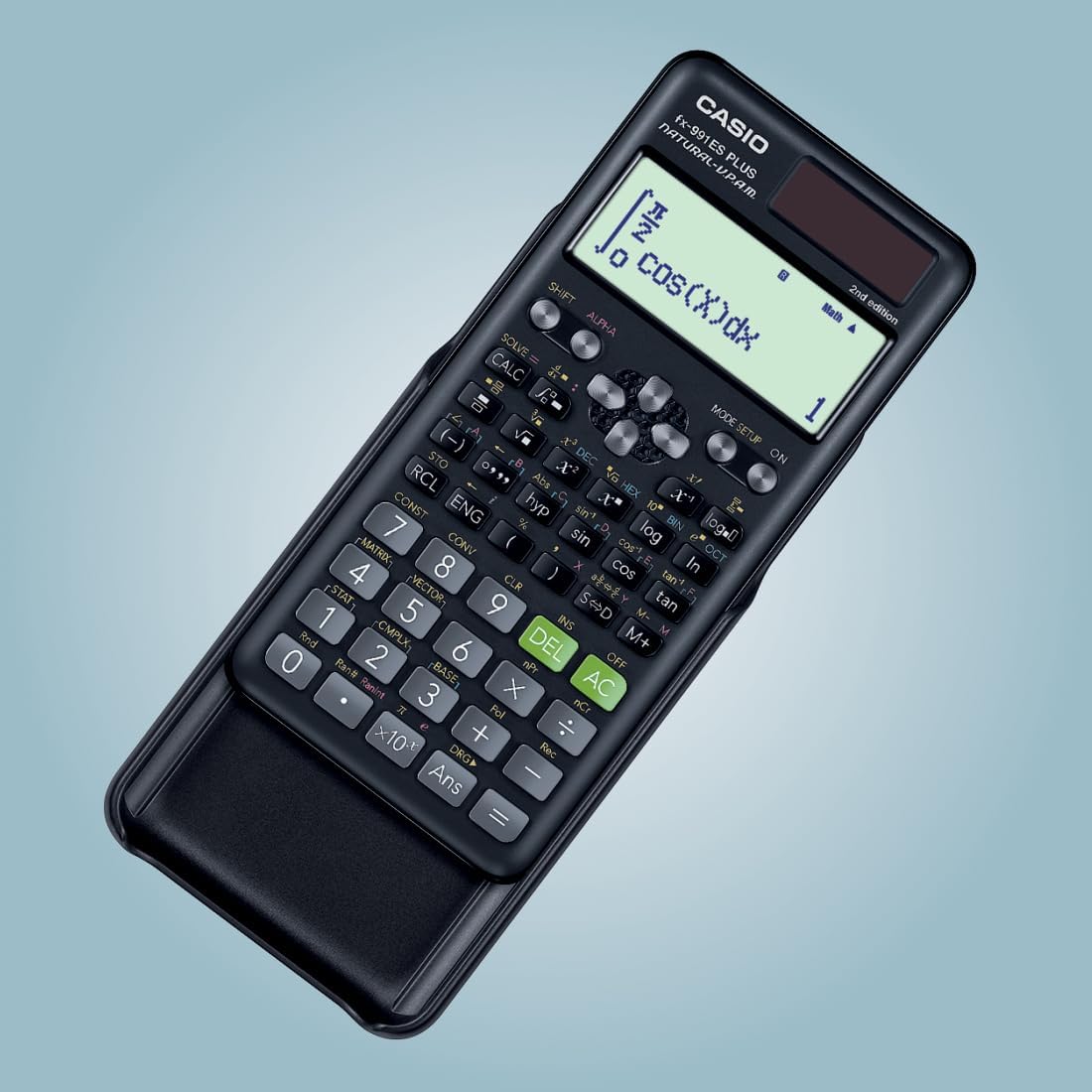

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon