Property Tax Calculator

Calculate your annual and monthly property taxes based on your property value, tax rate, and local assessment rules.

Property Information

Tax Calculation Results

Annual Property Tax

Monthly Tax Payment

Assessed Value

Effective Tax Rate

Understanding Property Taxes

Property taxes are annual taxes levied on real estate by local governments. The amount you pay depends on your property's assessed value and your local tax rate.

Key Components

- Property Value: The market value of your property as determined by local assessors.

- Assessment Ratio: The percentage of your property's market value used for tax purposes. Some jurisdictions assess at 100%, while others use a lower percentage.

- Tax Rate: Also known as the millage rate or mill rate. This is the amount of tax per $1,000 of assessed value.

- Exemptions: Reductions in taxable value, such as homestead exemptions, senior citizen exemptions, or veteran exemptions.

How Property Tax is Calculated

Calculation Formula

Step 1: Calculate Assessed Value = Property Value × Assessment Ratio

Step 2: Subtract Exemptions = Assessed Value - Exemptions

Step 3: Calculate Annual Tax = Taxable Value × Tax Rate

Step 4: Calculate Monthly Tax = Annual Tax ÷ 12

Example Calculation

• Property Value: $300,000

• Assessment Ratio: 100%

• Tax Rate: 1.2%

• Exemptions: $0

Annual Tax: $300,000 × 1.2% = $3,600

Monthly Tax: $3,600 ÷ 12 = $300

Property Tax Tips

Ways to Lower Your Property Tax

- • Apply for homestead exemptions

- • Appeal your property assessment if too high

- • Check for senior citizen or veteran exemptions

- • Look into agricultural exemptions if applicable

- • Keep records of home damage or deterioration

Important Considerations

- • Property taxes fund local services and schools

- • Rates can change annually based on local budgets

- • Home improvements may increase your assessment

- • Some states allow property tax deductions

- • Payment schedules vary by jurisdiction

Note: Property tax rates, assessment methods, and exemption rules vary significantly by location. This calculator provides estimates based on the information you enter. For accurate tax amounts and specific rules in your area, consult your local tax assessor's office or county property appraiser.

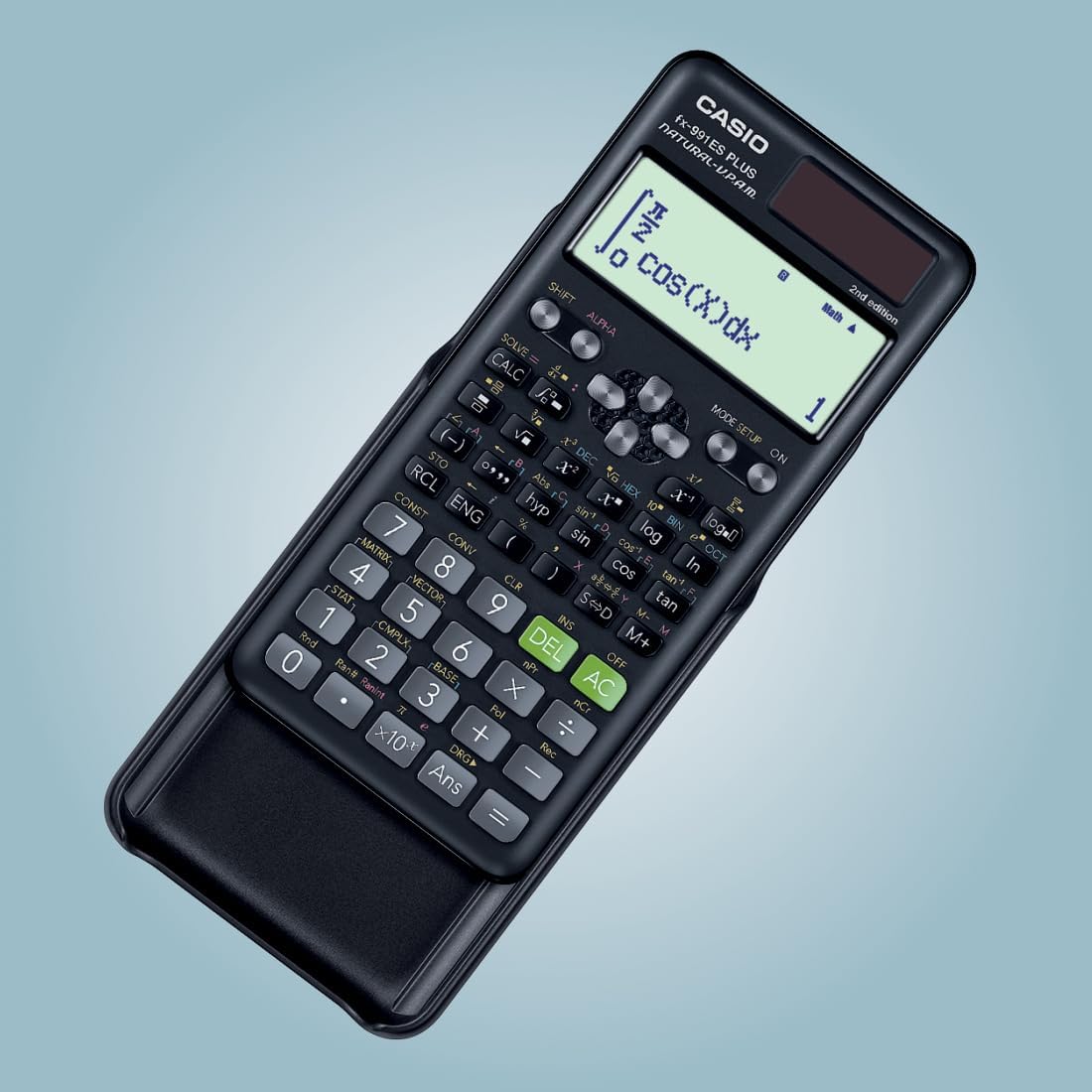

Recommended Calculator

Casio FX-991ES Plus

The professional-grade scientific calculator with 417 functions, natural display, and solar power. Perfect for students and professionals.

View on Amazon